The Accidental Taxpayer Tax Tips for Crossing Borders in Business and in Life Presented by Meril Markley International Tax Principal Houston Business and. - ppt download

Speaker] This event is being recorded and will be available for playback. Please select the green check mark to confirm you un

Speaker] This event is being recorded and will be available for playback. Please select the green check mark to confirm you un

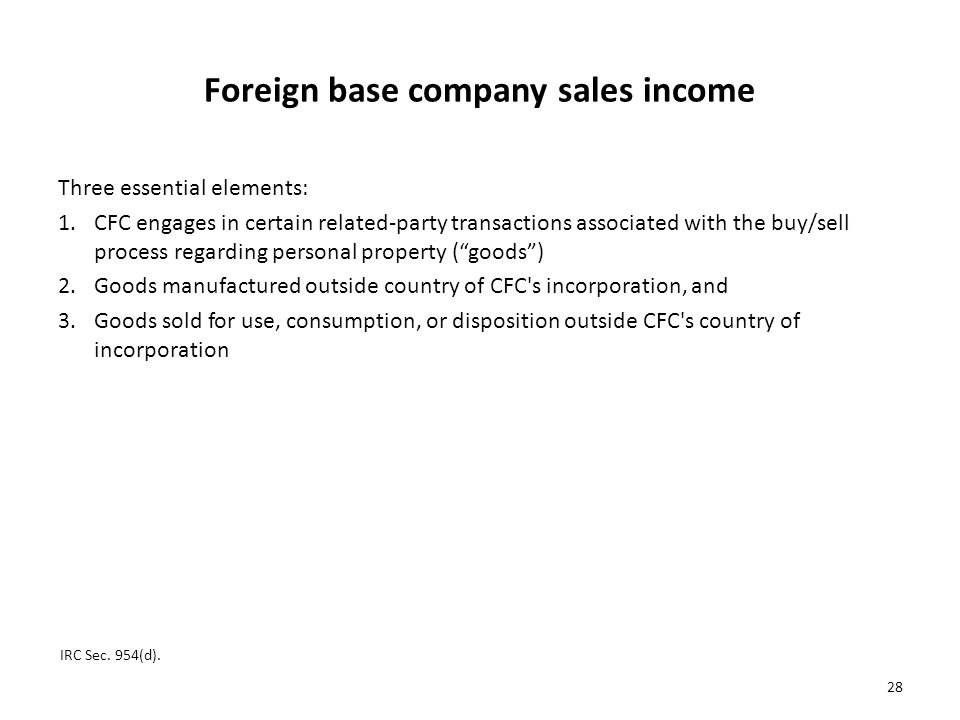

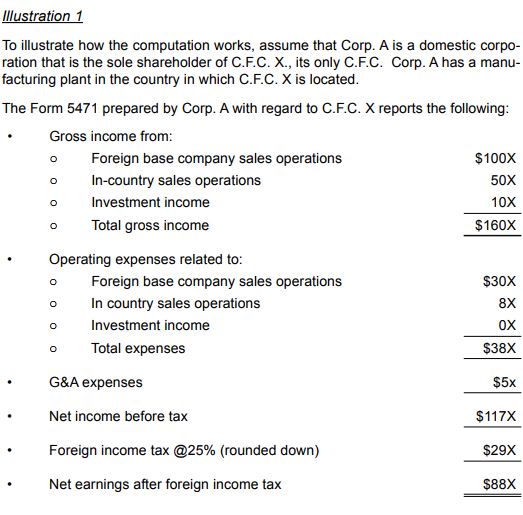

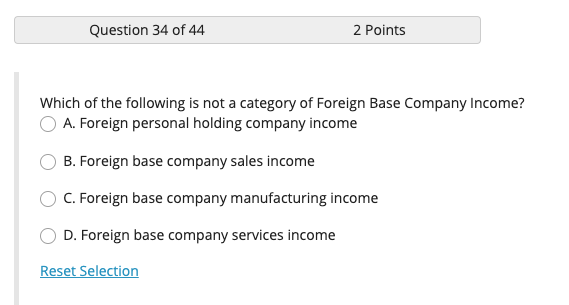

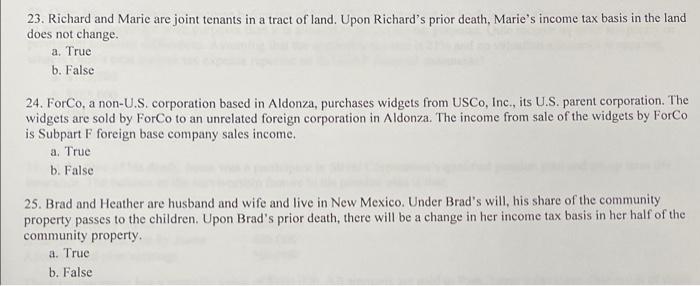

Foreign Base Company Sales and Services Income: An Overreaching Anachronism or an Essential Element of the Controlled Foreign Co

What does FBCSI mean? - Definition of FBCSI - FBCSI stands for Foreign Base Company Sales Income. By AcronymsAndSlang.com

Page 2063 TITLE 26—INTERNAL REVENUE CODE § 954 § 954. Foreign base company income (a) Foreign base company income For purpos