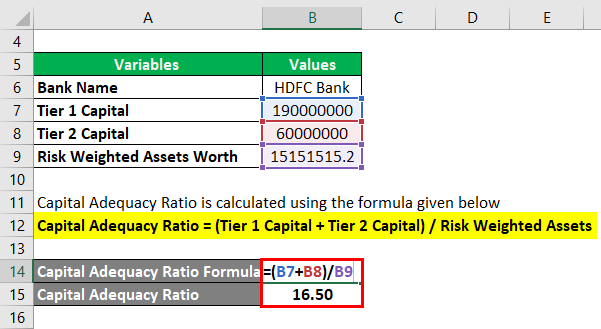

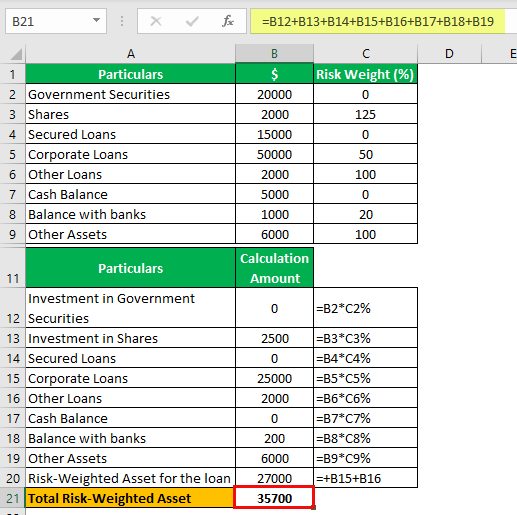

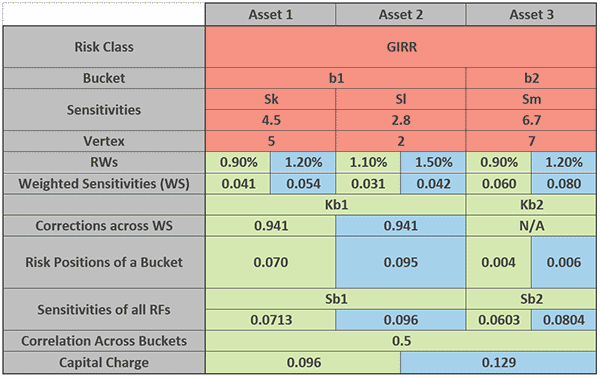

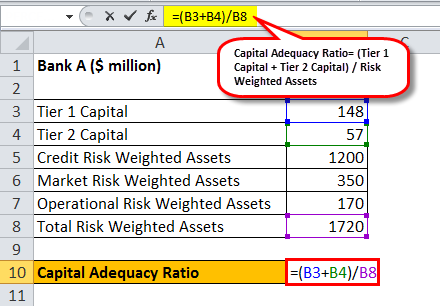

Meaning of Capital charge and calculation of capital requirement — Banking School - India Dictionary

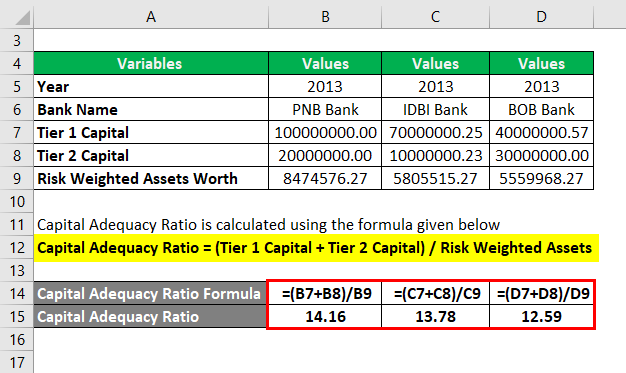

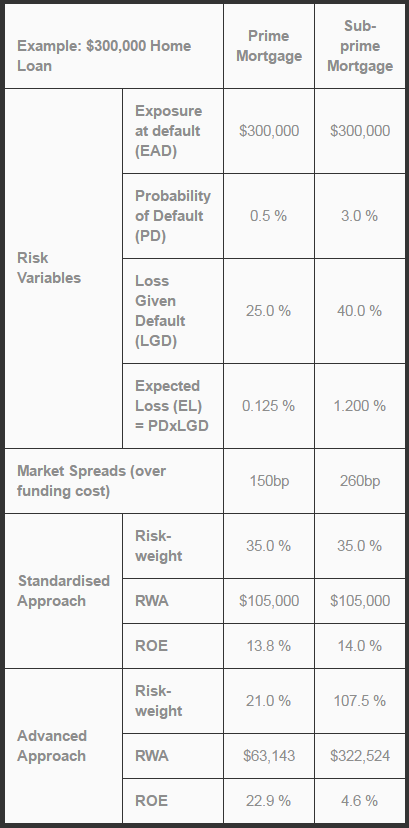

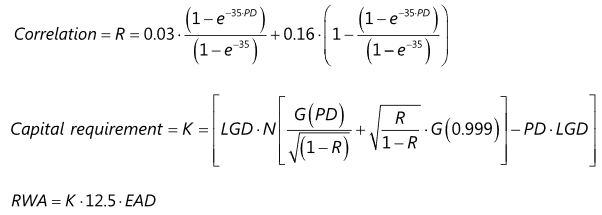

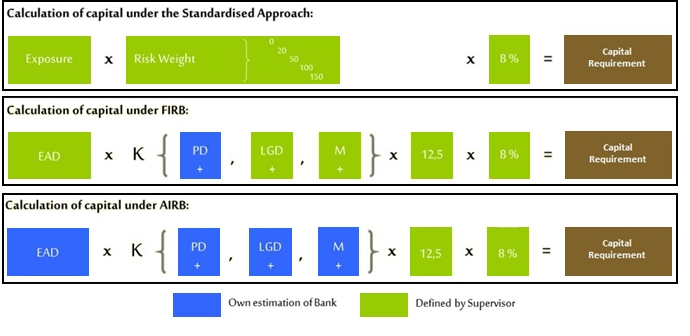

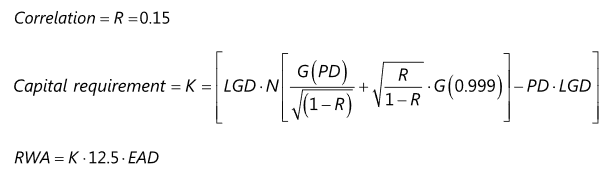

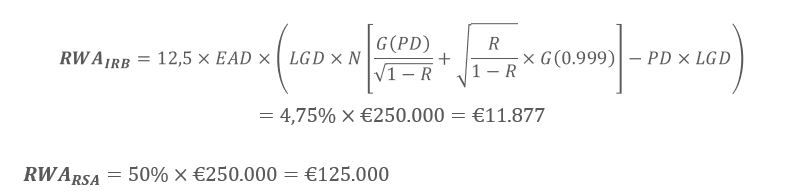

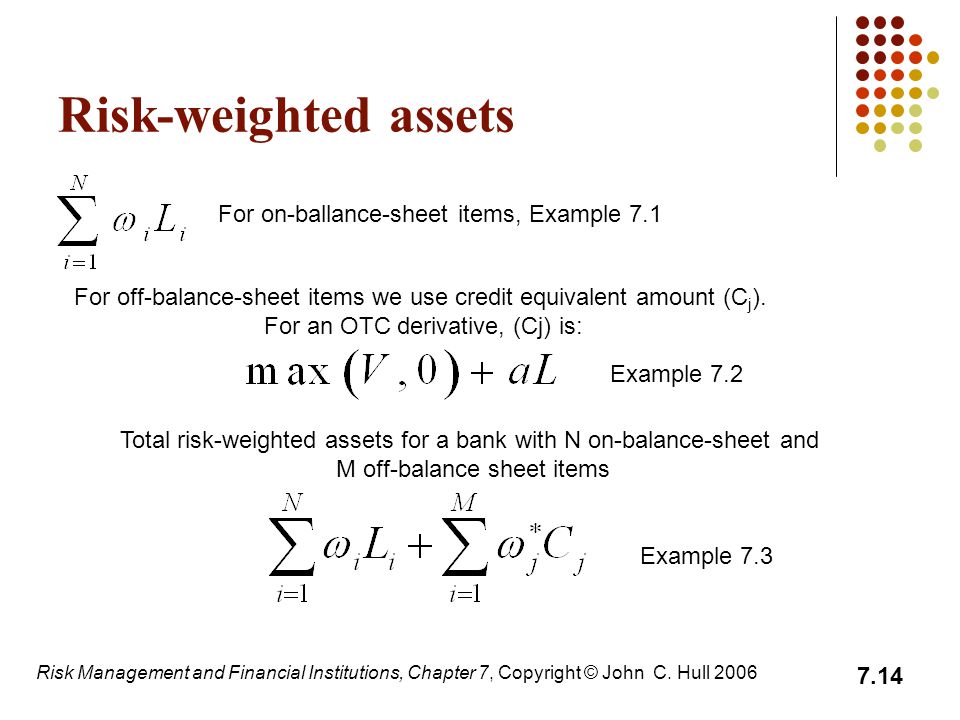

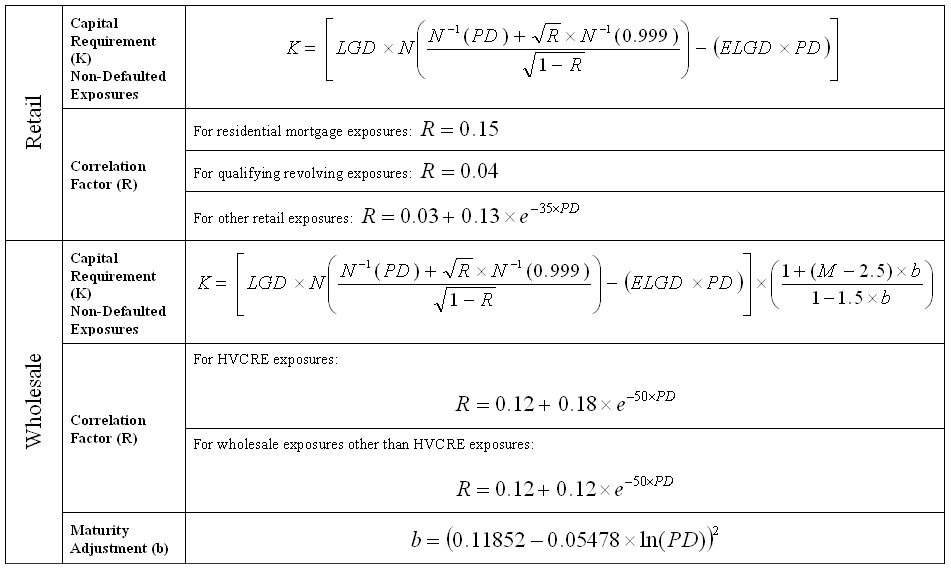

Basel II Capital Accord - Notice of proposed rulemaking (NPR) and supporting Board documents - Draft Basel II NPR - Part IV - Risk-Weighted Assets for General Credit Risk